The 15-Minute Money Habit That Changed Everything

A simple 15-minute daily habit can completely transform your relationship with money, and thousands of people are already seeing life-changing results. This powerful routine works for busy professionals drowning in financial chaos, families struggling to get ahead, and anyone who feels overwhelmed by their money situation but can't find hours to dedicate to budgeting.

The 15-minute money habit isn't about complex spreadsheets or restrictive budgets that fail after two weeks. It's a streamlined daily review that builds real financial awareness and creates lasting change without eating up your entire evening.

You'll discover the exact step-by-step process that takes just a quarter-hour each day but delivers results that compound over months and years. We'll also dive into the mental roadblocks that trip up most people when they try to stick with money habits, plus advanced techniques to get even more value from your daily sessions once the routine becomes second nature.

This isn't another overwhelming financial system. It's the one habit that makes every other money decision easier.

The Simple 15-Minute Daily Money Review That Transforms Your Financial Life

Track every dollar that comes in and goes out

Your money moves faster than you realize, and most of it happens without conscious thought. Every day, dollars slip through digital transactions, automatic payments, and quick purchases that barely register in your mind. The magic happens when you create a simple tracking system that captures every financial movement in real time.

Start with a basic smartphone app or a simple notebook. The tool doesn't matter – consistency does. Record each income source and every expense, no matter how small. That $4 coffee, the $12 lunch, the $2.99 subscription you forgot about – everything gets logged. This isn't about judgment or restriction; it's about awareness.

Most people discover they're spending 20-30% more than they thought they were. Hidden charges, forgotten subscriptions, and mindless purchases add up to hundreds of dollars monthly. When you track everything for just two weeks, patterns emerge that shock even the most financially aware individuals.

Identify your biggest money leaks instantly

Money leaks are the silent killers of financial progress. They're different from regular expenses because they provide little to no value while draining significant resources. Your 15-minute daily review becomes a detective tool for spotting these wealth destroyers.

Common money leaks include:

-

Subscriptions you never use but keep paying for

-

Bank fees from overdrafts or minimum balance violations

-

Credit card interest from carrying balances

-

Impulse purchases that sit unused

-

Premium services you've forgotten about

-

Late payment penalties and fees

During your daily review, scan for recurring charges that don't align with your actual usage. Many people find they're paying for three streaming services but only watch one, or maintaining gym memberships they haven't used in months. These discoveries often save $100-500 monthly with zero lifestyle impact.

Spot spending patterns you never noticed before

Human behavior follows patterns, and spending habits are no exception. Your daily money review reveals these patterns within days, showing you exactly when, where, and why your money disappears.

You might discover you spend 40% more on weekends, or that stress triggers expensive food delivery orders. Maybe you overspend during specific times of the month, or certain emotions lead to retail therapy sessions. These insights are gold because they predict future spending behavior.

Track these key pattern indicators:

| Pattern Type | What to Look For | Typical Discovery |

|---|---|---|

| Time-based | Daily/weekly spending peaks | Monday coffee runs cost $200/month |

| Emotional | Purchases during stress/happiness | Stress shopping adds $300/month |

| Location | Where most money gets spent | Convenience stores drain $150/month |

| Category | Which expenses grow unexpectedly | Entertainment budget doubled unnoticed |

Create awareness that leads to automatic better choices

Awareness transforms behavior without force or willpower. When you review your spending daily, your brain starts making different choices automatically. This psychological shift happens because the review process creates a mental connection between actions and consequences.

Before tracking, buying decisions happen in isolation. You want something, you buy it, you forget about it. After establishing the daily review habit, every purchase becomes part of a larger story you'll revisit later. This knowledge changes the decision-making process at the moment of purchase.

People who maintain daily money reviews report making better choices without conscious effort. They naturally gravitate toward better deals, question unnecessary purchases, and feel more satisfied with their spending decisions. The review creates a feedback loop that strengthens over time, making good financial choices feel effortless rather than restrictive.

The key is consistency over perfection. Miss a day here and there, but maintain the habit long enough for it to rewire your financial decision-making process. Most people see dramatic changes in their spending patterns within 30 days of daily reviews.

How This Quarter-Hour Investment Pays Massive Dividends

Calculate the compound effect of small daily improvements

Your daily 15-minute money review creates a snowball effect that most people completely underestimate. When you track your spending, review your goals, and make tiny adjustments each day, you're not just managing money – you're building a financial muscle that grows stronger with every session.

Here's what happens mathematically: If your 15-minute review helps you save just $5 per day by catching unnecessary expenses, that's $1,825 annually. Invested at 7% returns, this becomes $26,000 over 10 years. But the real magic happens when those small daily insights compound into bigger behavioral changes.

People who stick to this habit report finding subscription services they forgot about, negotiating better rates on insurance, and catching billing errors – often saving hundreds of dollars monthly. One participant discovered a $47 monthly gym membership she hadn't used in two years during her third week of reviews.

The psychological compound effect runs even deeper. Each day you complete your review, you build confidence and financial awareness. By month three, you'll spot patterns and opportunities that were invisible before. Your brain literally rewires itself to think more strategically about money.

Discover why consistency beats perfection every time

Perfect financial planning sessions that happen once a month pale in comparison to imperfect 15-minute check-ins that happen daily. Your brain craves consistency, not intensity. When you show up every single day, even when you don't feel like it, you create neural pathways that make good financial decisions automatic.

Think about brushing your teeth – you don't need motivation or perfect technique every time. You just do it. The same principle applies to money management. Daily repetition transforms conscious effort into unconscious habit.

The data backs this up powerfully. Studies show people who check their finances daily make 23% fewer impulse purchases and stick to budgets 40% more consistently than those who review monthly. Daily reviewers also report 60% less financial anxiety because money never feels "out of control."

Perfect monthly sessions often get skipped when life gets busy. But 15 minutes? You can find that even on your worst days. You might only check your bank balance and scan yesterday's expenses, but you still showed up. That consistency builds trust with yourself and keeps money top-of-mind when you're making spending decisions throughout the day.

See how 15 minutes saves hours of financial stress later

Every minute you spend in daily review prevents hours of future financial firefighting. When you catch problems early, they're small and manageable. When you ignore them, they become time-consuming emergencies that steal entire weekends and create sleepless nights.

Consider Sarah, who spent 15 minutes each morning reviewing her accounts. In week two, she noticed her credit card balance climbing faster than usual. A quick investigation revealed her subscription streaming services had doubled after free trials expired. Five-minute fix, $89 monthly savings. Without daily reviews, she would have discovered this during tax season – after paying $1,068 in unnecessary fees.

Daily reviewers rarely face month-end budget surprises because they course-correct in real-time. They don't spend Saturday afternoons frantically categorizing expenses or arguing with their partner about overspending. They don't lose sleep wondering if they have enough money for upcoming bills.

The stress reduction alone pays massive dividends. Financial anxiety affects sleep quality, work performance, and relationships. When you know exactly where your money stands every single day, that background worry disappears. You make decisions from a place of clarity instead of fear, leading to better outcomes across every area of your life.

Your 15-minute investment creates a buffer zone between you and financial chaos, transforming reactive scrambling into proactive control.

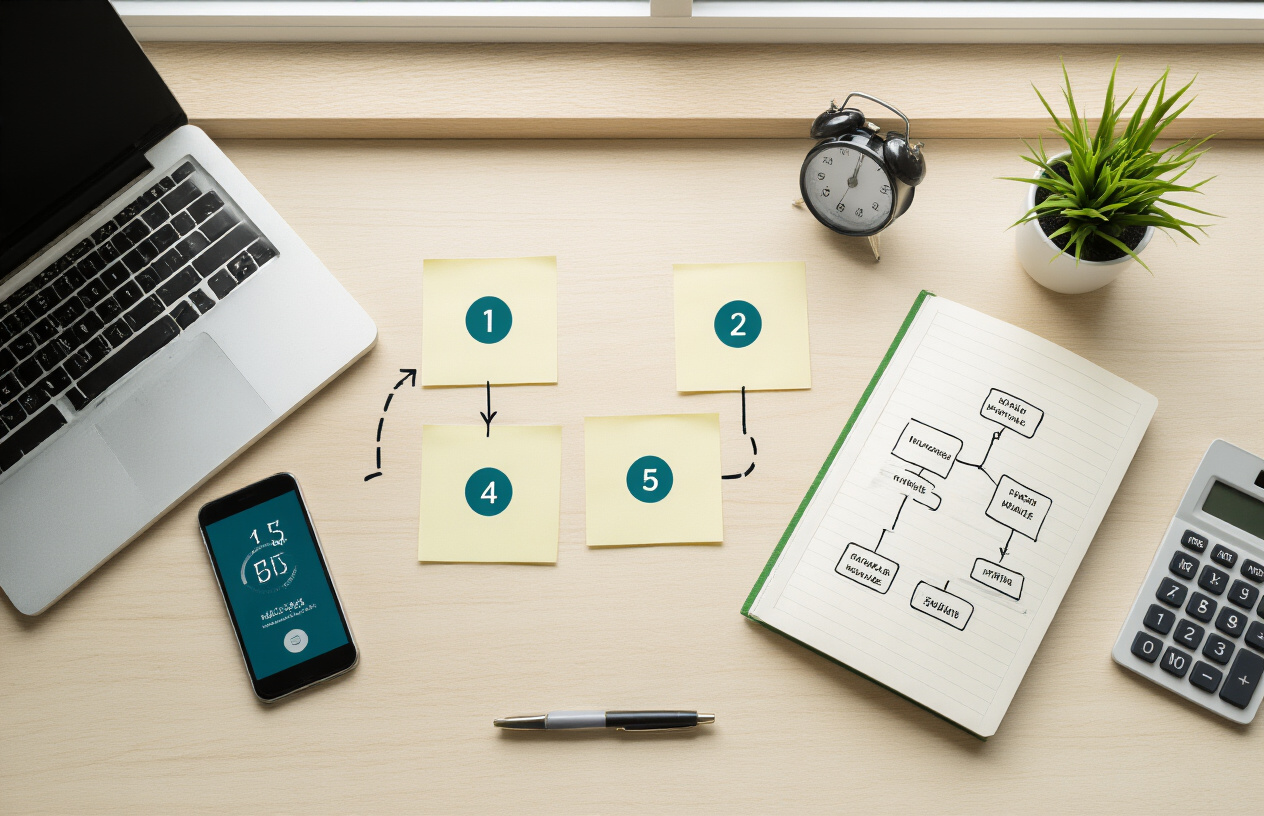

The Exact Step-by-Step Process That Anyone Can Follow

Set up your simple tracking system in under 5 minutes

Getting started requires nothing more than a notebook, smartphone app, or simple spreadsheet. The key is choosing one method and sticking with it. Most successful money reviewers use their phone's notes app or a basic banking app that categorizes transactions automatically.

Create just four columns or sections: Income, Fixed Expenses, Variable Expenses, and Goals. That's it. Don't overcomplicate this with fancy software or elaborate categories. The simpler your system, the more likely you'll use it daily. Many people fail because they spend hours setting up complex tracking systems that become overwhelming within a week.

Your tracking system should capture three essential pieces of information: what you spent, where you spent it, and how it aligns with your priorities. If you can't set this up in five minutes, you're making it too complicated.

Review yesterday's transactions and categorize them

Open your banking app or check your receipts from the previous day. Don't try to categorize everything perfectly - aim for "good enough." Most expenses fall into obvious buckets: groceries, gas, entertainment, bills, or unexpected purchases.

The magic happens when you notice patterns. Did you buy coffee three times yesterday? Did that "quick" grocery run turn into $80? These small revelations compound over time into major insights about your spending behavior.

Focus on the biggest transactions first, then work your way down. A $200 purchase deserves more attention than a $3 coffee, but both matter. Look for purchases that surprised you or didn't align with your intentions. These are your learning opportunities.

Check your progress toward monthly financial goals

Pull up your monthly targets and see where you stand. This isn't about perfect precision - rough estimates work fine. If you planned to spend $400 on groceries this month and you're at $250 with ten days left, you're probably on track.

Create a simple visual system. Some people use percentages (50% through the month, 60% of grocery budget used = slightly behind). Others prefer dollar amounts remaining. Choose what makes sense to your brain.

The goal isn't to judge yourself harshly when you're behind. It's to make small course corrections before small problems become big ones. If you're overspending on restaurants, you might cook more meals at home for the rest of the month.

Plan one money-smart action for today

Every review session should end with one specific action you'll take that day. This could be as simple as "pack lunch instead of buying it" or as significant as "research that insurance quote."

The action should be small enough to actually complete but meaningful enough to matter. Good examples include: transferring money to savings, comparing prices before a planned purchase, or declining an unnecessary subscription renewal.

Write down your chosen action and check it off when complete. This creates momentum and proves that your 15-minute investment is generating real results. Small daily actions compound into major financial improvements over months and years.

Adjust your approach based on what you learned

The final step is the most important: adapting your strategy based on what yesterday's data revealed. If you consistently overspend on weekends, plan weekend activities with specific budgets. If you impulse-buy when stressed, develop alternative stress-relief strategies.

This isn't about radical changes - it's about tiny adjustments that prevent repeated mistakes. Maybe you move your savings transfer to happen automatically on payday instead of hoping you'll remember later in the month.

Pay attention to your emotional responses during the review. Do certain categories of spending trigger guilt or anxiety? Do you feel excited about progress in some areas? These emotional signals often reveal deeper patterns than the numbers alone.

The most successful people treat this step like a scientist studying their own behavior. They stay curious rather than judgmental, asking "What can I learn from this?" instead of "Why did I mess up again?"

Real Results From People Who Made This Their Daily Ritual

How Sarah eliminated $400 monthly in wasteful spending

Sarah, a marketing manager from Denver, discovered her money was disappearing into what she called "invisible expenses." Before starting her 15-minute daily reviews, she couldn't explain where nearly half her paycheck went each month. The breakthrough came when she began tracking every transaction during her morning coffee routine.

During her first week of reviews, Sarah noticed $47 in subscription services she'd forgotten about – streaming platforms, apps, and gym memberships she never used. By week two, she identified her lunch spending averaged $18 daily instead of the $8 she estimated. Her evening food delivery habit was costing $280 monthly, not the $100 she thought.

The daily reviews created awareness that changed her behavior naturally. Sarah started meal prepping on Sundays, canceled unused subscriptions immediately, and chose restaurants over delivery apps. Within three months, she reduced monthly spending by $400 without feeling deprived. The money redirected to her emergency fund, which grew from $200 to over $1,600 in six months.

Sarah's key insight: "I wasn't overspending on big purchases. Death by a thousand tiny cuts was killing my budget. The 15-minute reviews showed me exactly where my money went, and that awareness automatically changed my choices."

The couple who paid off $15000 debt in 18 months

Mark and Jennifer from Phoenix faced $15,000 in credit card debt across four different cards. Their minimum payments consumed $380 monthly, and they felt trapped in an endless cycle. Traditional budgeting failed because they couldn't stick to rigid categories or track every expense throughout busy days.

Their 15-minute evening routine became a game-changer. Each night after dinner, they reviewed the day's spending together, celebrated wins, and identified opportunities. This daily check-in prevented small overspending from accumulating and kept their debt payoff goal front-of-mind.

The couple discovered patterns they'd missed before. Tuesday grocery runs averaged 40% higher than weekend trips due to impulse purchases. Their entertainment spending spiked during stressful work weeks. Date nights cost $120 when they went out but only $30 for creative home activities.

They redirected found money toward debt using the avalanche method, starting with their highest-rate card at 24.9% APR. Monthly debt payments increased from $380 to $950 as they eliminated wasteful spending. Extra income from Mark's side consulting went directly to debt instead of lifestyle inflation.

After 18 months of daily reviews, they made their final payment. Mark reflects: "The daily habit kept us accountable to each other and our goals. We couldn't ignore our progress or slip back into old patterns."

Why small business owners see immediate cash flow improvements

Small business owners face unique cash flow challenges that make daily financial reviews particularly powerful. Unlike employees with predictable paychecks, entrepreneurs deal with irregular income, seasonal fluctuations, and unexpected expenses that can derail their businesses overnight.

Restaurant owner Carlos from Austin struggled with inconsistent cash flow despite steady customer traffic. His 15-minute daily reviews revealed that food costs varied wildly based on purchasing decisions. Some days, his food cost percentage hit 45%, while profitable days stayed below 28%. The daily tracking helped him identify which suppliers offered better deals and when to buy in bulk versus daily purchasing.

Within 60 days, Carlos optimized his ordering schedule and negotiated better terms with key suppliers. His average food costs dropped to 30%, improving monthly cash flow by $3,200. More importantly, he could predict and prevent cash crunches before they happened.

Freelance graphic designer Maria from Seattle discovered similar benefits. Her daily reviews showed client payment patterns, helping her predict cash gaps weeks in advance. She noticed clients who paid within 10 days versus those who consistently took 45 days. This insight allowed her to adjust project scheduling and maintain steadier cash flow.

The immediate feedback loop helps business owners make rapid adjustments that employees in larger companies can't implement. Daily reviews become a competitive advantage in fast-moving markets.

Overcoming the Mental Barriers That Keep Most People Stuck

Why money shame prevents financial progress

Money shame shows up as that knot in your stomach when you open your credit card statement or the burning embarrassment you feel when friends talk about their investments while you're struggling to save $100. This toxic emotion creates a vicious cycle where shame leads to avoidance, avoidance leads to worse financial decisions, and worse decisions create more shame.

The root of money shame often traces back to childhood messages about money being "dirty" or "the root of all evil," or perhaps watching parents fight about finances. These early experiences program your subconscious to associate money management with pain, failure, or moral judgment.

Here's what money shame looks like in practice:

-

Avoiding bank statements and bills until the last possible moment

-

Making impulse purchases to temporarily feel better about your situation

-

Lying to yourself and others about your true financial position

-

Feeling like a failure when comparing your finances to others on social media

-

Believing you don't deserve financial success or stability

The antidote to money shame starts with radical self-compassion. Your current financial situation doesn't define your worth as a person. Every successful person has made money mistakes - the difference is they learned from them instead of hiding from them.

Transform money anxiety into empowered action

Money anxiety manifests as that racing heart when you think about retirement, the sleepless nights worrying about unexpected expenses, or the paralysis that strikes when trying to make investment decisions. This anxiety isn't just uncomfortable - it actively sabotages your financial progress by clouding your judgment and preventing you from taking necessary action.

The key to transforming anxiety into empowerment lies in changing your relationship with uncertainty. Instead of viewing financial unknowns as threats, start seeing them as puzzles to solve. This shift requires rewiring your brain's response to money-related stress.

Practical anxiety-to-action strategies:

| Anxious Thought | Empowered Action |

|---|---|

| "I'll never have enough for retirement" | "Let me calculate what I need and create a plan" |

| "The market might crash" | "I'll diversify my investments and focus on long-term goals" |

| "I don't understand investing" | "I'll educate myself for 15 minutes daily" |

| "What if I lose my job?" | "I'll build an emergency fund and develop multiple income streams" |

Start small with what you can control today. Anxiety thrives on abstract fears about the future, but action grounds you in the present moment. Your daily 15-minute money habit becomes a powerful anxiety-busting tool because it transforms overwhelming financial chaos into manageable, bite-sized tasks.

Remember: courage isn't the absence of fear - it's taking action despite the fear. Each small financial decision you make from a place of knowledge rather than anxiety builds your confidence muscle.

Break the cycle of financial avoidance once and for all

Financial avoidance is perhaps the most destructive money habit because it compounds every other problem. When you avoid looking at your finances, small issues become big problems, manageable debts become overwhelming burdens, and simple solutions become complex crises.

Avoidance feels protective in the moment but creates a false sense of security. Your brain tricks you into thinking that if you don't look at the problem, it doesn't exist. But unopened bills don't disappear, and ignored investment accounts don't magically grow.

The anatomy of financial avoidance:

-

Trigger: A bill arrives or you need to check your account balance

-

Emotional response: Anxiety, shame, or overwhelm surfaces

-

Avoidance behavior: You postpone dealing with it "until tomorrow"

-

Temporary relief: The anxiety subsides momentarily

-

Compound consequences: The problem grows larger and more intimidating

-

Increased avoidance: The cycle repeats with greater intensity

Breaking this cycle requires what psychologists call "exposure therapy" - gradually facing your financial reality in small, manageable doses. This is where your 15-minute daily practice becomes transformational. Instead of one overwhelming financial review session per month (which you'll likely avoid), you're committing to brief, regular check-ins that feel manageable.

Your avoidance-breaking toolkit:

-

Set a timer for exactly 15 minutes - this creates a boundary that prevents overwhelm

-

Start with the least threatening financial task (maybe just logging into your bank account)

-

Celebrate small wins - acknowledging one account balance is progress

-

Use the "two-minute rule" - if something takes less than two minutes, do it immediately

-

Create accountability by telling someone about your daily money habit

The magic happens when avoidance transforms into curiosity. Instead of dreading your financial check-ins, you'll start looking forward to tracking your progress and making small improvements each day.

Advanced Strategies to Maximize Your 15-Minute Sessions

Use Technology Tools to Automate the Boring Parts

Your smartphone can handle the heavy lifting while you focus on the big picture. Apps like Mint or YNAB sync with your bank accounts and categorize transactions automatically, cutting your review time in half. Set up spending alerts so your phone buzzes when you hit 80% of any budget category - no more surprise overages.

Banking apps now offer instant balance checks and spending summaries. Check your balances while your coffee brews each morning. Many banks also provide weekly spending reports that land in your inbox without any effort on your part.

Consider using automated savings rules too. Round-up apps like Acorns turn your daily purchases into investments. Your bank might offer automatic transfers that move $25 to savings every Friday. These small automations compound over time while keeping your 15-minute sessions focused on strategy rather than data entry.

Connect Your Daily Review to Bigger Financial Dreams

Every dollar decision connects to your bigger goals, but most people miss this link. During your daily review, spend 2-3 minutes visualizing what you're working toward. Planning a family vacation? Calculate how many days of current spending equals one day of that trip.

Create a simple progress tracker for major goals. If you're saving $15,000 for a house down payment, mark off each $500 milestone. Seeing progress makes the daily sacrifices feel worthwhile rather than restrictive.

Keep photos of your goals visible during review time. That dream kitchen remodel becomes real when you see the inspiration photo while deciding whether to order takeout again. Your brain needs these visual connections to maintain motivation through the boring middle months of any financial journey.

Build Accountability Systems That Keep You Consistent

Solo money management gets lonely fast. Find an accountability partner who also commits to daily financial check-ins. Text each other one spending win and one concern each day. This simple exchange creates positive peer pressure without judgment.

Consider joining online communities focused on specific financial goals. Reddit's personal finance communities offer daily threads where people share their wins and struggles. Seeing others face similar challenges normalizes your journey and provides real-time support.

Create consequences that actually matter to you. One person puts $10 in a jar every time they skip their money review - money that goes to a charity they dislike. Another person agreed to clean their roommate's bathroom for a week if they missed three reviews in a month. The key is making the consequence annoying enough to motivate consistency.

Scale Up Your Money Habits as You See Results

Start small, but don't stay small. Once your basic 15-minute review becomes automatic, add new elements gradually. Week one might focus only on checking balances and yesterday's spending. Month two could include reviewing subscription services. Month six might involve researching investment options.

Your growing financial awareness opens doors to bigger opportunities. People who master daily money reviews often discover they're ready for real estate investing, starting side businesses, or negotiating better salaries. The confidence from controlling small daily decisions builds capacity for larger financial moves.

Track your evolution with quarterly assessments. Compare your financial position every three months - not just account balances, but your comfort level with money conversations, your knowledge of investment options, and your ability to spot good deals. Most people are amazed at how much their financial sophistication grows from this simple daily practice.

Consider graduating to weekly planning sessions once daily reviews become effortless. Use this time for bigger picture analysis: comparing insurance rates, researching investment accounts, or planning major purchases. Your 15-minute daily habit becomes the foundation for increasingly sophisticated financial management.

Just 15 minutes a day can completely transform how you think about and manage money. The daily money review isn't some complicated financial strategy – it's a simple habit that helps you stay connected to your finances, catch problems early, and make smarter decisions without stress. When you spend a few minutes each day checking in with your money, tracking your spending, and planning ahead, you build the kind of financial awareness that most people never develop.

The best part? You can start today. Pick a time that works for you, grab your phone or a notebook, and commit to those 15 minutes. Don't worry about being perfect or having all the answers right away. The magic happens through consistency, not perfection. Thousands of people have already discovered how this small daily habit creates big changes in their bank accounts and peace of mind. Your financial future is waiting – all it takes is a quarter of an hour to get started.